News

News

Latest Update

News

News

News

News

Court of King Trump: The Way Media Moguls Are Yielding to Protect Crucial Agreements

Samantha Juarez

Samantha Juarez

News

News

Champions League Preview: Man City Welcome Napoli While Newcastle Take On Barcelona

Samantha Juarez

Samantha Juarez

News

News

News

News

Atletico Madrid along with Uefa to Examine Reported Spit Incident During Anfield Fixture

Samantha Juarez

Samantha Juarez

Today's Top Highlights

Stay updated with the latest insights and trends in online gaming

News

READ MORE

READ MORE

Oscar Piastri along with Lando Norris Assert They Control Their Personal Fate in Formula One Title Fight

Samantha Juarez

18 Sep 2025

News

READ MORE

READ MORE

Hodgkinson Breaks Boredom to Boost British Morale in the Championships

Samantha Juarez

18 Sep 2025

News

READ MORE

READ MORE

Countrywide Walkout Action Draws Hundreds of Thousands Protesting Throughout France

Samantha Juarez

18 Sep 2025

News

READ MORE

READ MORE

Corbyn and Sultana Clash Over New Political Party Registration

Samantha Juarez

18 Sep 2025

News

READ MORE

READ MORE

The Man Without Fear: Resurrected Formally Confirmed for a Third Season

Samantha Juarez

18 Sep 2025

News

READ MORE

READ MORE

Real Madrid Defender Asencio to Face Trial Over Accused Sharing of Private Footage

Samantha Juarez

18 Sep 2025

News

READ MORE

READ MORE

Jose Mourinho Is Back at Benfica Following Two and a Half Decades: Respected But Risky?

Samantha Juarez

18 Sep 2025

News

READ MORE

READ MORE

‘I’m a Hustler’: The Multifaceted Star on Music, Motherhood and Her Latest Film

Samantha Juarez

18 Sep 2025

News

READ MORE

READ MORE

Gaming Meme Sensation Faces Legal Dispute That Has Fans Upset

Samantha Juarez

18 Sep 2025

News

READ MORE

READ MORE

The Gaming Giant Apologizes to Game Creators for Hampering Title's Steam Release

Samantha Juarez

18 Sep 2025

News

READ MORE

READ MORE

Trump Is Set to Be Gone, But Britain’s Problems Will Persist. Starmer’s Invitation Proved to Be a Big Error

Samantha Juarez

18 Sep 2025

News

READ MORE

READ MORE

Egyptian Authorities Confirm 3,000-Year-Old Artifact Was Taken and Destroyed

Samantha Juarez

18 Sep 2025

Recent Posts

News

News

News

News

News

News

News

News

September 2025 Blog Roll

August 2025 Blog Roll

July 2025 Blog Roll

June 2025 Blog Roll

Sponsored News

News

News

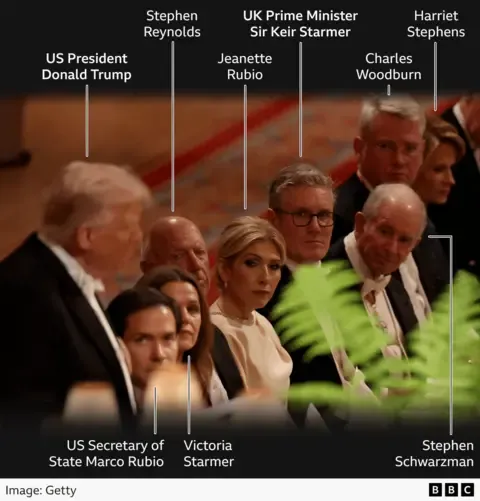

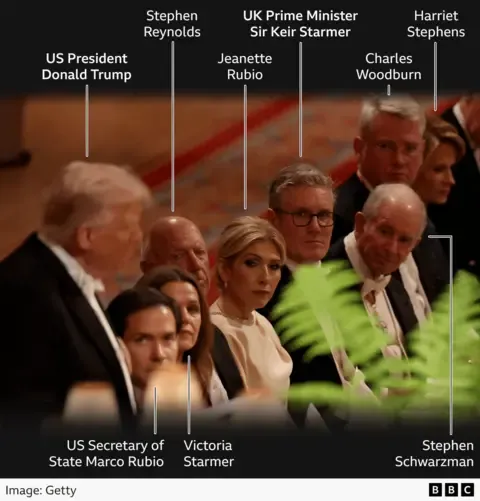

Royals, Trump Supporters and Technology Executives: Notable Observations from the State Banquet Guest List

By Samantha Juarez

•

18 Sep 2025

By Samantha Juarez

•

18 Sep 2025

News

News

‘I Sought to Run Away with Narcotics, Tablets and Booze’: The Tennis Legend on His Turmoil and Chaos Following Leaving Tennis

By Samantha Juarez

•

18 Sep 2025

By Samantha Juarez

•

18 Sep 2025

News

News

Media Storm Targets the Young Sprinter, Though He Boasts a Special Strength to Manage

By Samantha Juarez

•

18 Sep 2025

By Samantha Juarez

•

18 Sep 2025

News

News

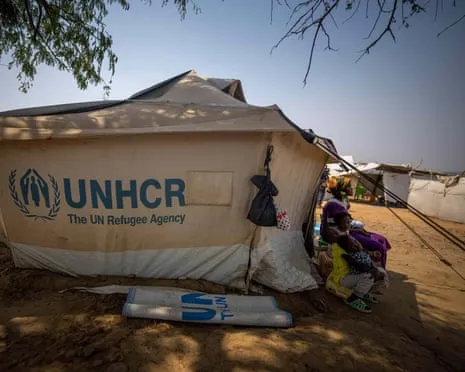

Cataclysmic Crisis within the Gaza Strip as Military Tanks Push Forward

By Samantha Juarez

•

18 Sep 2025

By Samantha Juarez

•

18 Sep 2025

News

News

Unveiling the Remastered Realm of Dragon Quest VII

By Samantha Juarez

•

18 Sep 2025

By Samantha Juarez

•

18 Sep 2025

News

News

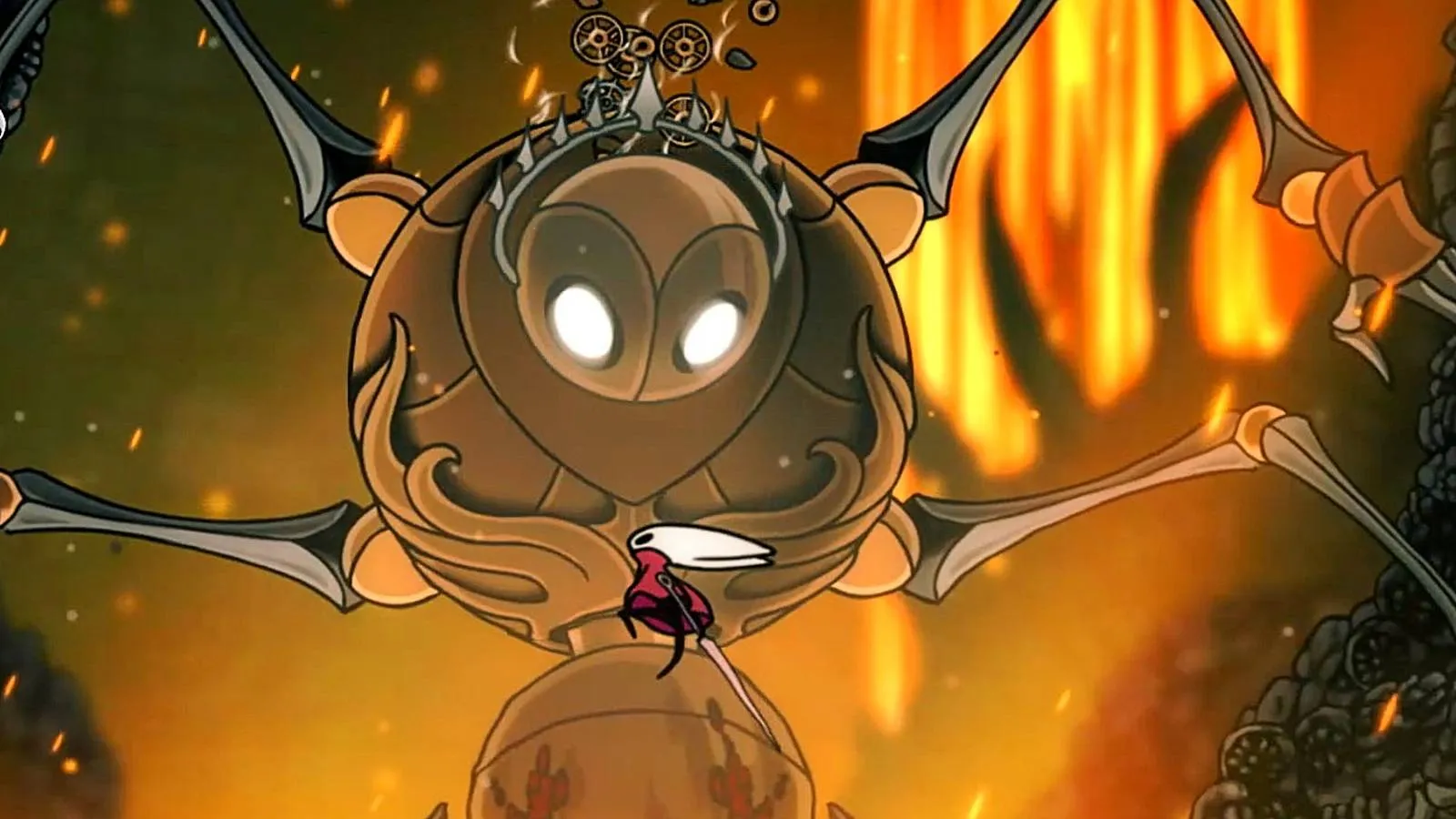

The Reason Team Cherry's Latest Title Is So Dang Hard, As Explained by the Game's Creators

By Samantha Juarez

•

18 Sep 2025

By Samantha Juarez

•

18 Sep 2025